For today’s young adults, managing finances is more than just a task—it’s a source of anxiety in an uncertain world. The complexity of financial products and economic challenges only heighten their sense of insecurity.

But how does this reality look on a global scale, especially among Gen Z and Millennials, and how can brands match their needs?

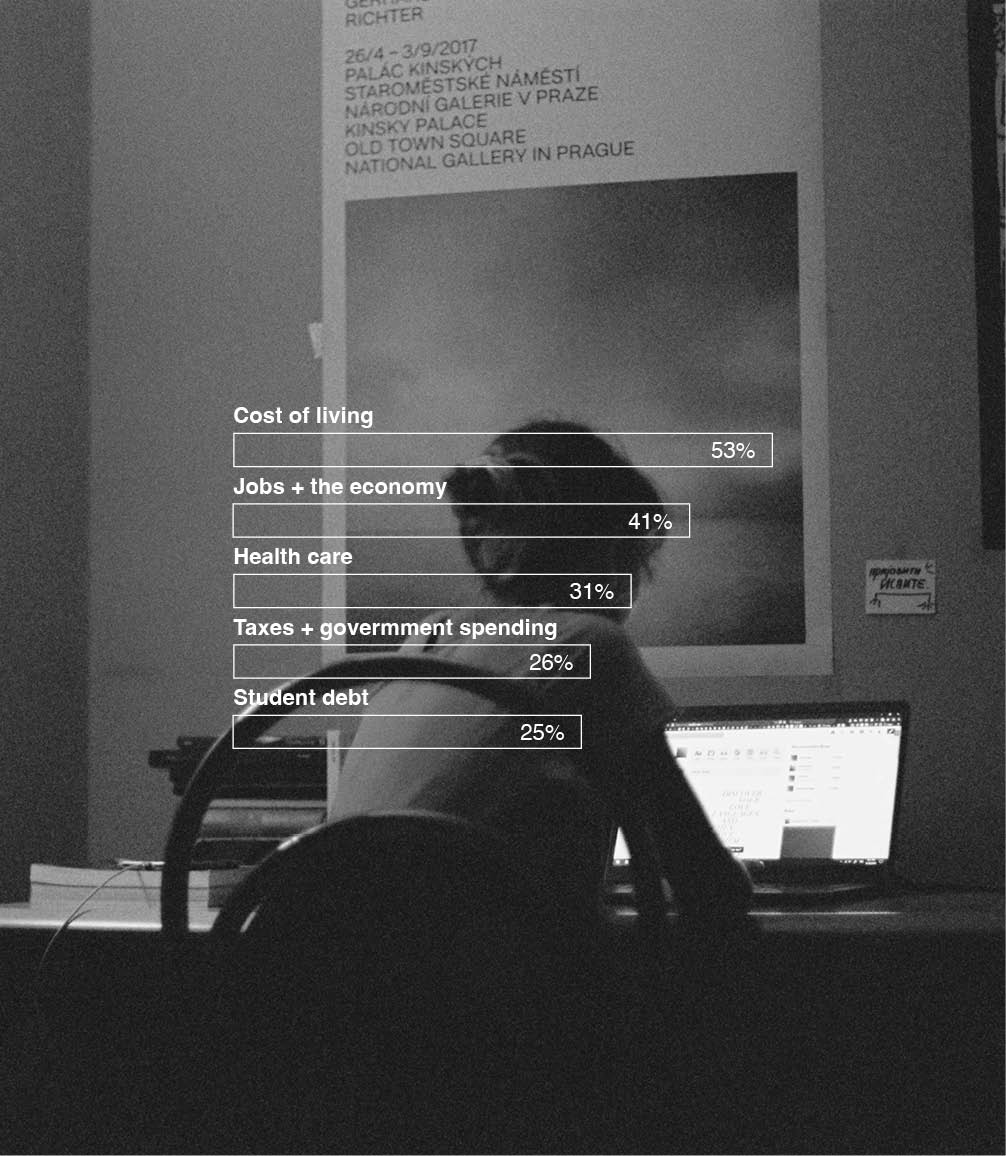

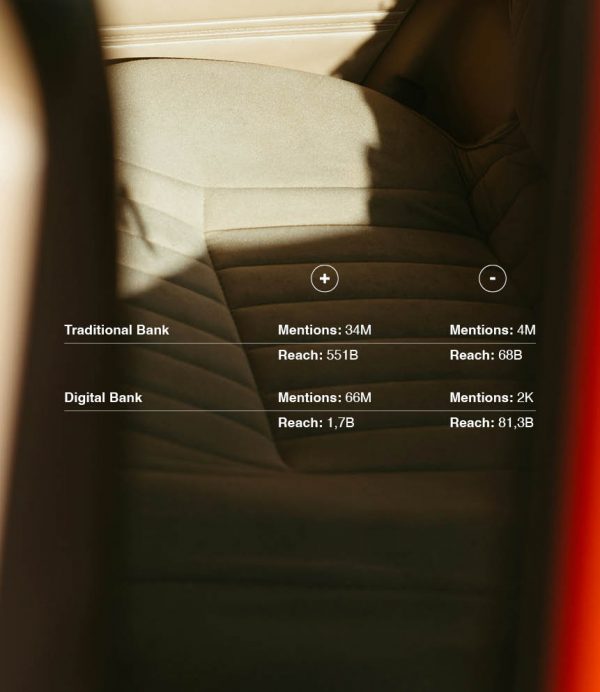

One of our analysis included over 6,200 social media conversations, revealing that economic and social challenges are top concerns. Even so, young people aren’t just passive observers. A recent survey shows they demand transparency, simplicity, and digital innovation from their financial partners. Overall, we analysed nearly 40 M social conversations.

This paper delves into these insights, uncovering the key drivers behind Millennials’ and Gen Z’s financial decisions and highlighting opportunities for the industry.